If your income does not exceed RM35000 a year youre eligible to receive a rebate of RM400. This relief is applicable for Year Assessment 2013 and 2015 only.

Best Natural Beauty Products To Use During Pregnancy

The Inland Revenue Board LHDN has also done away with a sub-category of this tax relief that previously allowed individuals to claim RM1500 for each parent RM3000 for mother and father if they did not make a claim for medical treatment for their parents.

. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Self Parents and Spouses Automatic Individual Relief Claim allowed. Speak to a Care Advisor Email us at malaysiahomageco or call us at 016 299 2188 or request a callback from our friendly Care Advisory team.

Unmarried child under 18. The tax relief on expenses for medical treatment special needs and parental care will also be raised from RM5000 to RM8000 he said during the tabling of the Budget 2021 in parliament on Friday Nov 6. Medical Expenses for Parents.

The allowable relief is RM1500 for one mother and RM1500 for one father. Medical treatment special needs and carer expenses for parents. Expansion of scope and ncrease in tax relief for medical expenses on i serious.

Books journals magazines printed newspapers sports equipment and gym membership fees. Computer annually payment of a monthly bill for internet subscription Smartphones The maximum income tax relief amount for the lifestyle category is RM2500. Must be evidenced by a registered medical practitioner or written certification of a qualified carer.

Includes care and treatment by a nursing home and non-cosmetic dental treatment. The conditions of entitlement for each relief must be satisfied in order to minimize the income tax liability. There are various items included for income tax relief within this category which are.

If more than one individual claims for this deduction the amount has to be equally divided according to number of individuals claiming for that same parent. Personal Tax Reliefs in Malaysia Reliefs are available to an individual who is a tax resident in Malaysia in that particular YA to reduce the chargeable income and tax liability. If the parents under the childs care are regarded as healthy a total claimable amount of RM3000 is available where relief of RM1500 is allocated for each parent.

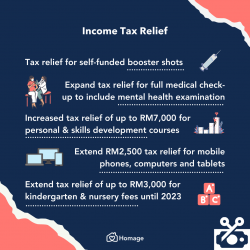

Self and spouse rebates. On top of that the parents shall be residents in Malaysia and the medical treatment or care services must be provided in Malaysia. Higher tax relief limit for payments of nursery and kindergarten fees extended Parents paying fees to registered childcare centres are originally allowed to claim of up to RM2000.

Parents must reside and treatment must be provided in Malaysia. Under the PENJANA stimulus package this limit is increased to RM3000 to be provided until the end of 2022. You can also get an extra RM400 if your spouse has no income.

Parents are natural or foster parents maximum 2 persons Aged 60 years and above Annual income of not exceeding RM24000 each Parents must be tax resident in Malaysia 8. Parents can get a tax relief of RM2000 for each unmarried child of theirs under 18 years old. Extension of period for tax relief in respect of net annual contributions to the national education savings scheme Skim Simpanan Pendidikan NasionalTo further encourage parents to save for the costs of their childrens higher education fees the tax relief of up to RM8000 will be extended until year assessment year 2022.

Parental care relief of RM1500 YA 2016 onwards for each parent with certain conditions. Learn more about our range of services and find out how Homage Care Professionals can help. He added that the tax relief for a full health screening would be increased from RM500 to RM1000.

Up to RM9000 Granted automatically to an individual for themselves and their dependents. RM1500 per parent only allowed if no claims made under medical expenses for parents. The education tax relief for your children falls under Parenthood which we will cover below.

Tax Relief for Parents i Medical expenses for parents RM 8000 Including medical treatment expenses special needs or carer expenses Tax relief for parental care is not available now Tax Relief for Whole Family Individual spouse and child i Education or medical insurance RM 3000 Insurance premium for education or medical benefit. Are you aware of the new tax. Dependents Disabilities 2.

Increase in tax relief for medical treatment special needs and parental care ex penses It is proposed that the income tax relief for medical treatment special needs and parental care expenses be increased from RM5000 to RM8000 with effective from YA 2021. Parents whove contributed are eligible for a relief of up to RM8000 for their annual net savings total deposit in 2021 minus total withdrawal in 2021. Companies are not entitled to reliefs and rebates.

Up to RM 5000. The tax relief for parental care of RM3000 is valid up to YA2020 and no further extension has been gazetted. Make a Care Plan together.

2 This income tax relief can be shared with other siblings provided that the total tax relief claimed does not exceed MYR 1500 for. Other ways to cut your payable taxes. It is important to note that only one 1 child is permitted to claim relief for parents for any given year and each parents annual income must not exceed RM24000.

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

Sudocrem Healing Cream For Nappy Rash 60g Nappy Rash Skin Care Specials Emollient Cream

Secretly Obvious Shea Butters Customer Label Ideas Online Labels

Animal Essentials Herbal Ear Rinse For Cat Dog 4 Oz

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Aveeno Baby Mommy Me Daily Bathtime Solutions Gift Set 4 Items Walmart Com

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Personal Income Tax Relief 2021

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Amazin Graze Graze Lululemon Logo Retail Logos

Personal Tax Relief 2021 L Co Accountants

Honey Don T Ever Date A Mama S Boy She Will Always Be In Your Business

Malaysia Income Tax 2022 A Guide To The Tax Reliefs You Can Claim For Ya 2021 Buro 24 7 Malaysia

35 Inspiring Adhd Quotes And Sayings Adhd Awareness Month

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Hand Foot And Mouth Disease Incubation Period Hrf